Compound Interest is the interest that is earned on the original principal and accumulated interest.

The Key Takeaways

- Compound interest is interest earned on interest.

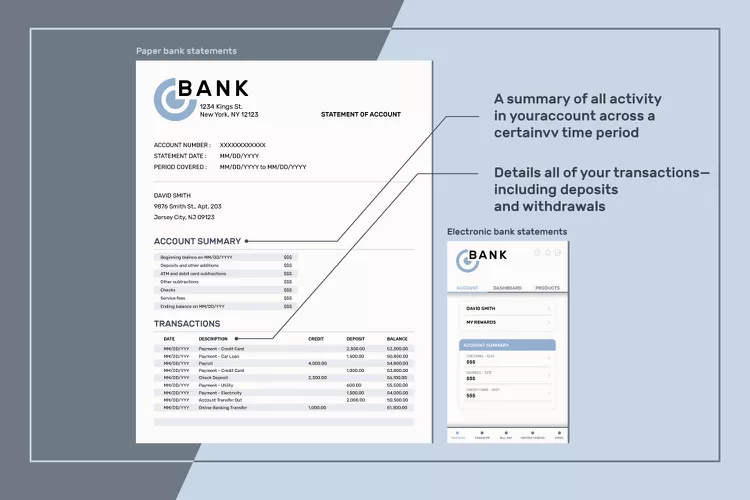

Already Earned - In many banks, interest compounded daily allows you to accumulate your money.

to grow your money more quickly. - Compound interest can be calculated easily using online calculators.

- Early savings can maximize your gains.

Compound Interest: Definition and Examples

Compound Interest is the interest earned on the original principal plus accumulated interests. You earn interest not only on your initial deposit but also on the interest.

Compound interest is similar to the “snowball” effect. Snowballs start small but grow bigger as more snow is added. It grows faster as it grows.

How does compound interest work?

Start by understanding simple interest. You deposit money and the bank gives you interest.

If you deposit $100 and earn 5% interest per year, you will receive $5 in return after one year. What happens next year? Compounding is the answer. You will earn interest for your initial deposit , and on that interest.

Your account balance will now be $105, and not $100, so the interest you earn the second year is higher than the previous year.

Note:

Even if you do not make any further deposits, your earnings can still increase.

- Year 1: A $100 deposit earns $5 in interest or 5%, which brings your balance up to $105.

- Year two: Your $105 earns $5.25 in interest. Your balance is $10.25.

- Year three:Your $110.25 balance earns 5% or $5.51 in interest. Your balance increases to $115.76.

This is an example where interest compounds yearly. Many banks, including Online Banks compound interest daily, and add it to your account every month. This makes the process even faster.

Compounding is not in your favor if you borrow money. It’s actually to the lender’s benefit. You pay interest for the money that you have borrowed. If you don’t pay the full amount due the following month, you will be charged interest on both the amount borrowed and the interest that you’ve accrued.

Compound Interest Formula

Compound interest can be calculated in several different ways. You can gain valuable insights into your saving goals by learning how to calculate compound interest yourself. When you do calculations, you can examine different “what-ifs” and compare the results.

Note:

This calculation is made easy by a calculator, which does all the math, allowing you to compare borrowing costs or investment returns.

Some people like to do the calculations themselves in order to see the numbers more closely. You can use either a financial or regular calculator.

Calculate compound interest using the formula below:

Plug in the following variables to use this calculator:

- A : the amount that you will end up with.

- P Your initial deposit, also known as principal.

- r : the annual rate of interest, in decimal format .

- n : the total number of compounding periods in a year (for instance, weekly is 52 and monthly is 12).

- T: The amount of Time (in years) that your money compounded.

How to do the math

If you have $1,000, you can earn 5% compounded each month. What will you have in 15 years?

- A = P (1 + [r / n])

- A = 1000 (1 + [.05/12]) (12*15)

- A = 1000 (1.00041666 …)) (180).

- A = 1000 (2.113703)

- A = 2113.70

You’d be worth about $2,114 after 15 years. Due to rounding, your final total may differ slightly. The $1,000 is your initial deposit and the $1,114 remaining is interest.

Google Docs has a example spreadsheet that shows you how to use it. You can also download a copy and use it with your own data.

Spreadsheets

Spreadsheets will do all the calculations for you. You’ll use a Future Value calculation to calculate the final balance. Microsoft Excel, Google Sheets and other software programs offer this feature, but you will need to adjust your numbers.

You can use the Excel function for future values to calculate the value using the example given above:

Separate each variable into a separate cell. As an example, cell A1 could have “1000” as your initial deposit and cell B1 could show “15”, which represents 15 years.

To calculate compound interest in a spreadsheet, you need to think of the compounding period rather than thinking about years. The periodic interest rate for monthly compounding is simply divided by 12 because there are twelve months in a year. Most organizations use 360 or even 365 for daily compounding.

- =FV(rate,nper,pmt,pv,type)

- =FV([.05/12],[15*12],1000,)

In this example, has been omitted from the pmtsection, which is a periodic add-on to the account. This would be useful if you added money to your account on a monthly basis. Typeis not also used in this instance. This would be used if you were to calculate based on the due date of payments. 1

Rule 72

Another way to estimate compound interest quickly is by using the Rule of 72. You can use this method to get an idea of how long it’ll take you to double your money. It works by comparing the interest rate with the time period you will earn the rate. Multiplying the number of years with the interest rate will give you an approximate estimate. You can double your money if you multiply 72 by the interest rate.

Example 2: You are saving $1,000 and earning 5% annual percentage yield, or APY. How long until you reach $2,000?

Find out the answer by dividing 72 by 5. It will take approximately 14.4 years for your money to double.

Example: If you have $1,000 today, then in 20 years you will need $2,000. What must you earn to double your money in 20 years?

You can use the same information to figure out how many years it will take to reach 72. You’ll need an APY of approximately 3.6% to achieve your goal. 72 divided by 20 is 3.6.

What it Means to Individual Investors and Saver

Compounding can work in your favor as an individual investor or saver.

Saving Early and Often

Time is your best friend when it comes to growing your savings. Compound interest will grow your money exponentially the longer you leave it untouched.

You will have earned $800.61 of interest if you deposit $100 each month for five years at 5% compounded monthly. If you don’t make any more deposits after that, your account will have an additional $7573.87 interest after 20 years. This is much higher than the $6,000 initial deposit, thanks to compounding.

Check the APY

Compare bank products like savings accounts and CDs by comparing the yield. The annual percentage yield takes into account compounding and gives a true rate. The APY is usually advertised by banks because it’s higher than the interest rates. It’s important to try and get good rates on your savings. However, it is not worth switching banks just for an extra 0.10%.

Pay down debts quickly and pay extra when you can

Only paying the minimum for your credit card will cost you a lot. Your balance may even increase as you barely scratch the surface of interest charges. Avoid capitalizing interest charges, which adds unpaid interest to your balance. Pay the interest when it accumulates and you won’t be surprised after graduation. You’ll save money on interest even if you are not required to.

Keep Borrowing rates Low

The interest rate on your loan will not only affect your monthly payment but also determine the amount of time you will need to repay your debt. Double-digit interest rates are common on credit cards. It is difficult to manage. It may make sense to combine debts in order to lower interest rates and pay off your debts. This could save you money and speed up the repayment process.

What makes compound interest so powerful?

When interest is paid repeatedly, compounding occurs. After the first two or three cycles, compounding interest becomes more powerful.

Frequency

The frequency of compounding is important. Daily compounding, for instance, has more dramatic results. Look for savings accounts that offer daily compounding. Even if you only see monthly interest payments, calculations can be made daily. Some accounts calculate interest only monthly or annually.

Time is a factor.

Compounding becomes more dramatic when done over a long period of time. When money is allowed to grow, it will result in a greater number of “credits” or calculations.

Interest Rate

Your account balance will also be affected by the interest rate over time. Compound interest can overpower a low rate. Over long periods of time, an account that compounds at a lower interest rate may end up with a larger balance than one calculated using a simple formula. Calculate the probability of this happening and find the break-even point.

Deposits

Your account balance can be affected by both withdrawals and deposits. The best way to grow your money is by adding regular deposits or letting your money grow. By withdrawing your earnings you reduce the compounding effect.

Start Amount

Compounding is not affected by the amount of money that you begin with. Compounding is the same whether you start with $100, $1,000,000 or more. You may see bigger results if you make a larger deposit. However, you won’t be penalized if you keep your accounts separate or start small. When planning your future, it’s important to consider percentages and the length of time. What will you earn and for how long are two key questions. Dollars are a direct result of the rate and timeframe.