Your financial institution prepares a bank statement each month. A bank statement shows all the transactions and income related to an account.

Understanding your bank statement will help you to learn more about your spending habits, and can also help you make better financial decisions. We’ll look at the information that’s contained in your bank statement to see how it can give you a clear picture of your finances.

What is a bank statement?

The bank statement will detail all transactions that have been made on your account during a given month. You can view all the money you have received and spent on your bank statement. Dates and parties involved in each transaction are also shown. You can then see who you paid and when the transaction cleared the bank. This information will help you better manage your savings, and make more informed financial decisions.

The following information is included in a typical bank statement:

- Your name, address, bank account number and other personal identifying information

- The time period covered by your statement of bank accounts, which is usually one month. Statements don’t start every month at the first. Your statement may run from the 13th day of the current month until the 12th day of the following month.

- The customer service number of the bank and the instructions on how to report fraud and mistakes

- Balance at the beginning and the end of the period

- The total amount of all deposits made into your account including direct deposits (including checks), transfers, reimbursements, payments on us items and interest earned

- All withdrawals including transfers, purchases, ATM withdrawals and automatic payments

How does a bank statement work?

The bank statement will show you what has happened to your account in the last month. It will detail your spending habits as well as any expenses.

Bank statements begin by grouping together all deposits, so you can see exactly what was deposited in your account over the previous month. The next section will summarize your withdrawals. The summary will show you your account balance as of the first of the month. It will then show the ending balance of your account after the withdrawals and all deposits have been made.

The bank statement will then show you each transaction, including the dates, amounts and payees. A bank statement for a check account can be as long as several pages, depending on the number of times you have used your account to pay expenses. You will see the transactions in chronological order. You can see the detailed list of all transactions to get an idea when money enters your account and when it leaves.

The transaction details also include information on where the deposit originated and where the expenses went. Review the transaction, and especially the expense, carefully to ensure they are accurate.

Note:

You should contact your financial institution immediately if you find any errors on your statement. You have 60 days in general to contest any inaccurate or fraudulent information.

Your bank statement may also contain documents that allow you to obtain a loan.

How long should I keep my bank statements?

You may need your previous bank statements if you are applying for a mortgage or going through a divorce. Banks are required by law to store your bank statements at least for five years. You should be able access them during this time, even if your account has been closed.

You can either keep paper copies or download the statements to your computer. When you don’t need your bank statements anymore, it is best to shred the paper versions and delete any electronic copies.

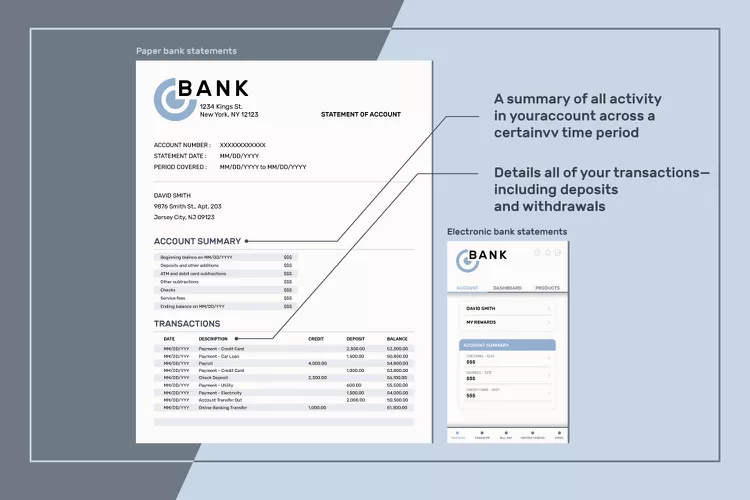

Paper Bank Statements and Electronic Bank Statements

You can choose the method of receiving your bank statement from most banks. You can choose to receive your bank statement by mail or electronically.

Note:

It may make sense to switch from paper statements to electronic ones if your bank charges a fee.

Logging into your account is usually necessary to access your electronic statements. Look for the navigation item that says bank statements. If you don’t see a statement option on your navigation, it may be found under “Services” and “Account Information”. You can then choose the month you want to view. You can usually save the statement to your computer as a PDF or print it.

The Key Takeaways

- Your bank statement summarizes all transactions in your account over a specified time period.

- A bank statement details all of your transactions–including deposits and withdrawals–so you can identify potential fraud.

- You can receive your bank statement in hard copy or electronically. However, you might be charged a small fee if it is sent to you by mail.

- Even if you close your account, banks must keep your bank statement accessible for at least 5 years.