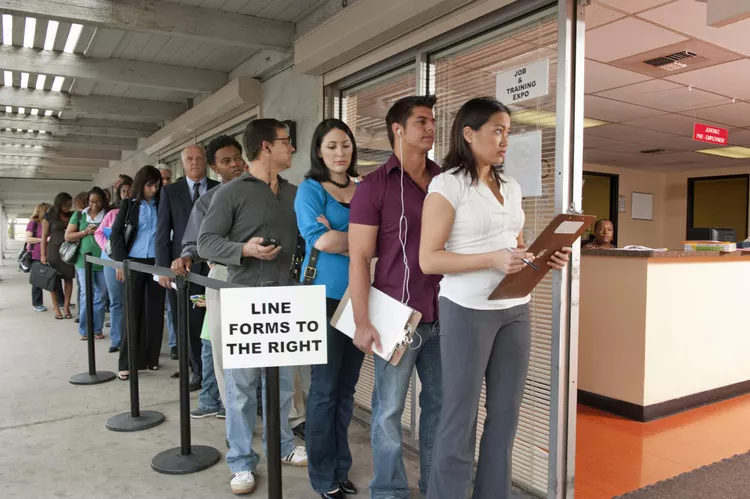

The unemployment rate in the United States, which is the percentage of people who want to work but do not have one, remains low, as the economy continues its recovery from COVID-19.

The Bureau of Labor Statistics keeps track of unemployment and employment on a month-to-month basis. The current unemployment rate tells us more about the economy as a whole and how it affects the finances of average Americans.

By the Numbers

- In November 2022 the unemployment rate was at 3.7%, which is on par with levels before the pandemic. This number is identical to that of October. Since March, unemployment has been in the range 3.5%-3.75%. 1

- There were six million unemployed people in total.

- In November, 263,000 new jobs were created, but the rate of labor force participation remained the same at 62.1%.

What does the current unemployment rate mean for you?

Wages rise when businesses hire, and unemployment decreases. This is good news both for your wallet and you. This may not be the case.

Due to the low number of unemployed, employers are forced to compete harder to hire employees. This means that wages will rise, but inflation will also follow. Gas, groceries and almost anything else that you buy will be more expensive due to inflation.

Note:

Since 1958, the Phillips Curve has been used to study the inverse relationship between high inflation and low unemployment.

Federal Reserve raises interest rates to try and help consumers, but this also increases the cost of borrowing for both businesses and consumers. High interest rates can make it difficult for consumers to purchase a home or car. They also make it harder for businesses to invest money in equipment and more staff, which is bad for the job market.

What is the difference between unemployment and jobs reports?

Because they come from different surveys, the unemployment rate and the figures in the jobs report do not always reflect the same thing.

The household survey is used to calculate the unemployment rate. The survey answers are used to determine who is and isn’t employed.

The establishment report is more commonly known as the “non-farm payroll report.” This survey of business describes how many new jobs or losses were experienced by industry.

These discrepancies are expected, and the estimates are revised each month as more data is received. These discrepancies were expected and are updated each month with new data. 2

How to use the Unemployment Rate

Remember that the unemployment rate is a leading indicator . The unemployment rate is a lagging indicator, as employers lay off employees only after the economy slows.

The companies will not hire new employees after a recession ends until they are sure the economy is going to remain strong. The recession may last for several months and the economy may improve before the unemployment rate falls. This is not a good tool for predicting trends but can be useful to confirm them.

Recent Unemployment Statistics

To put the report in perspective, you can look at the unemployment rate since 1929.

After a few years, the unemployment rate increased to a record 24.8%. The unemployment rate in April 2020 soared to 14.7% within a month.

The unemployment rate peaked in October 2009 at 10%. The two spikes in unemployment were caused by recessions.

FAQs (Frequently Asked Questions)

How is unemployment calculated?

The U.S. Bureau of Labor Statistics calculates unemployment by dividing the eligible workforce by the number of people not employed. The eligible workers are 16-year-olds and older who were able to work full-time, and actively sought work over the last four weeks. Temporarily lay-off workers also count.

What are the effects of a high rate of unemployment on the economy?

High unemployment can cause damage to the economy, even though it is an indicator of other problems. The gross domestic product suffers when workers don’t participate in the economy. This reduces economic growth. Unemployment can lead to health issues, which will increase healthcare costs in the future. According to studies, sustained high unemployment can cause damage to the earning potential of workers and their wealth over time. 5

What was the lowest rate of unemployment in U.S. History?

Want to read content similar to this? Subscribe to The Balance’s daily newsletter and receive insights, analyses, and financial advice delivered directly to your inbox!