DEFINITION

Unemployment Income is a federal and state insurance benefit that pays money to workers who are eligible for it, but have lost their job through no fault on their part.

Definition and example of Unemployment Income

Unemployment Income is the money that’s paid to people who are out of work and meet certain criteria. For example, they must be between jobs or out of work without their fault.

- Alternate Names: Unemployment compensation, unemployment benefits, unemployment insurance payments

How does Unemployment Income work?

In the United States, Unemployment Income is administered in partnership by the federal government and state unemployment offices. The purpose of this program is to replace wages temporarily for workers actively looking for a new job.

Note:

Wisconsin was the first state in 1932 to offer unemployment benefits to its unemployed residents. In 1935, three years after the Social Security Act, states were given the framework to develop their own unemployment benefits.

Each state has its own rules and requirements for unemployment benefits, as well as their own application process.

States vary on the maximum period of unemployment benefits. Most states offer unemployment benefits for up to 26 week. However, Arkansas only pays for 14 weeks and Massachusetts for 30.

State Unemployment Benefits

Those who wish to receive unemployment benefits must first meet the eligibility requirements of their state and then apply for unemployment benefits with their state. Most of the time, their unemployment status is due to circumstances that are beyond their control. For example, they may have been laid off, or their company has gone out of business. People who have been terminated because they broke company rules, or quit their job without good reason, are not usually eligible for unemployment benefits.

Both federal and state taxation is used to fund the administration of unemployment benefits and income in each state. Employers pay the Federal Unemployment tax (FUTA) at the federal level to fund administrative costs for federal and state unemployment benefits.

Employers and, in certain states, employees, pay unemployment taxes to the state in amounts determined by each state. These taxes are used to fund the unemployment trust fund of each state, from which benefits can be paid.

How much is the Unemployment Income Tax?

Unemployment income is generally considered taxable income when filing your federal income taxes. The tax rate that is currently applicable to your filing status will be applied. If you are filing under standard deduction, then unemployment compensation in 2021 could be taxed as ordinary income at a rate of 0%.

After the start of the new year states send recipients of unemployment benefits a form 1099-G that shows the amount they received in unemployment benefits the previous year.

Note:

The first $10,200 in unemployment income was tax-free to taxpayers who had a modified Adjusted Gross Income (AGI) of less than $150,000. 6. This exclusion only applied for the tax year 2020.

Some states allow recipients of unemployment benefits to choose whether taxes are withheld from their payment. If you do not want your unemployment income taxed, it is a good idea to make estimated tax payments.

The taxation of unemployment benefits varies from one state to another. Some states, such as California, exempt unemployment benefits from the state income tax while other states like New York tax unemployment benefits.

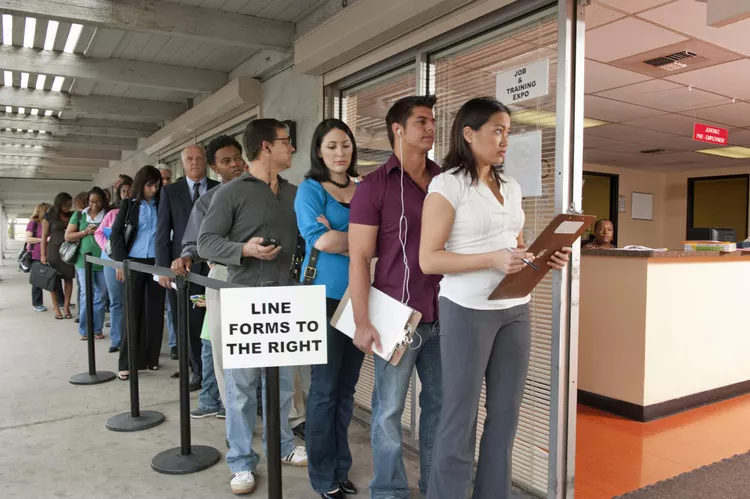

Unemployment Benefits: How to Get them

There are a few important steps you need to take to receive unemployment benefits.

- First, you must ensure that you are eligible. It is important to note that you must meet the minimum requirements for eligibility.

- Check with the unemployment insurance office in your state to see if there are any other requirements.

- You must first check if you qualify for unemployment benefits. Then, you need to apply through your state. You may have to wait a few extra weeks for your first payment, even if you’re approved for unemployment income.

- It is essential that you continue to meet the eligibility requirements of your state every week if you want to receive benefits. Each state has its own rules. However, the common requirements for maintaining benefits include being able and willing to work, actively searching for employment, reporting your earnings each week, as well as filing a weekly certificate.

- You can appeal a state’s decision if it denies you unemployment benefits. There are different rules in each state regarding how and when to appeal.

The Key Takeaways

- Unemployment income is the money paid to people who are unemployed for no reason.

- The federal government sets guidelines for each state’s unemployment program.

- Some states tax unemployment benefits while others do not.

- Check with your state unemployment office about the eligibility, application and maintenance of benefits process if you think you might be eligible for unemployment income.